Enhancing Company Portfolio Performance with Conversational AI

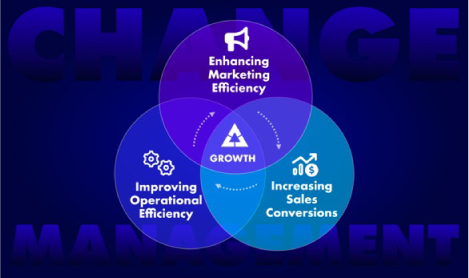

Conversational AI has emerged as a game-changer for businesses aiming to streamline operations, engage customers more effectively, and make informed decisions based on data. For private equity firms, this technology provides a unique opportunity to enhance the portfolio performance of their companies. Let’s dive into how conversational AI can revolutionize these companies by boosting operational efficiency, improving customer engagement, and driving data-driven decision-making.

Operational Efficiency

One of the standout benefits of conversational AI is its ability to automate routine tasks, allowing human resources to focus on more strategic initiatives. Take, for example, Patient Prism, a product tailored for the healthcare sector. This tool manages initial patient inquiries, schedules appointments, and handles follow-up communications, significantly reducing the administrative load on healthcare providers. By automating such repetitive tasks, portfolio companies can reallocate their workforce to core functions, enhancing both operational efficiency and overall productivity.

Improved Customer Engagement

Conversational AI tools like Patient Prism go beyond simple automation. They provide critical insights into customer behaviors and preferences. By analyzing interactions, these platforms can spot trends, identify pain points, and highlight areas needing improvement. This intelligence allows portfolio companies to refine their services, boost customer satisfaction, and foster loyalty. Happy customers are more likely to spread the word, leading to increased revenue streams and sustained business growth.

Data-Driven Decision Making

The data harvested by conversational AI platforms is invaluable for private equity firms aiming to optimize their portfolio companies’ performance. This data delivers a deep understanding of customer needs, market dynamics, and operational challenges. Armed with these insights, firms can make strategic decisions about resource allocation, process improvements, and overall business direction. This data-driven approach ensures that initiatives are not just reactive but proactive, positioning portfolio companies for sustainable growth and maximizing returns.

In today’s fast-paced business environment, adopting innovative technologies like conversational AI can provide a crucial competitive edge for private equity firms and their portfolio companies. Tools such as Patient Prism exemplify how AI can enhance operational efficiency, customer engagement, and strategic decision-making. As the adoption of conversational AI grows, early adopters are likely to reap significant benefits, unlocking new avenues for value creation and long-term success. Embracing this technology now will position firms to capitalize on its transformative potential fully.