CEO Pulse: Decoding the Decline

Vol 1, Issue 10

2021: the year Zoom and PPP loans took center stage. Suddenly, many found themselves in a digital mirror, critiquing the “social six” – those front teeth on full display during video calls. With pockets deepened by government assistance, the idea of sprucing up one’s digital facade became not just appealing, but almost a hobby. The Zoom+Cash effect led to a cosmetic spree, with people rushing to enhance their on-screen charm. This beauty boom saw a sharp uptick in the first half of 2021, but as the novelty faded and reality crept back in, the fervor for facelifts, virtual or otherwise, simmered down to pre-pandemic levels by the year’s end.

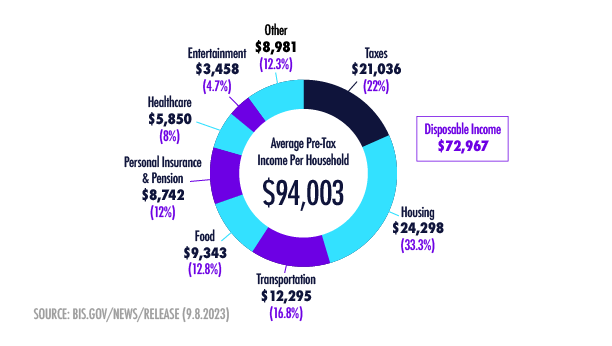

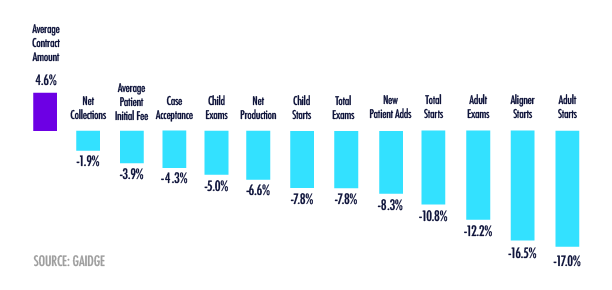

The decrease in case acceptance and net production points to broader economic influences and possibly consumer hesitation in elective dental care investment. This overview underscores the need for strategic adaptation within the orthodontic sector to navigate changing market conditions.

Decoding the Decline

Let’s delve into the three primary factors contributing to the decline in clear aligner starts: economic challenges, rising patient financing rates, and shifts in marketing strategies and Google’s algorithm changes.

Marketing Budgets & Google Changes: In early 2023, DSOs and OSOs faced a complex challenge: reduced marketing budgets, often dropping to around 2-4% of projected revenue, coincided with significant shifts in consumer spending and major updates from Google affecting analytics, ads, and search algorithms. This budget contraction made it difficult to allocate sufficient funds specifically for clear aligner campaigns. As described by a DSO CEO, this led to a two-part problem: not only was there less money overall, but the niche marketing efforts required for clear aligners—such as targeted AdWords groups and keywords—received even less focus due to the broader need to attract general dental patients.

Consequently, the emphasis on landing pages and other critical elements for attracting clear aligner patients diminished, impacting the ability to effectively market these treatments. This scenario underscores the importance of agile marketing strategies and the necessity for DSOs to rapidly adapt to maintain visibility and effectiveness in a rapidly evolving digital landscape.

Here's what you can do:

Choose the Right Marketing Partner: Select an agency with a strong track record in the dental industry and expertise in multi-channel marketing within multi-site framework. Look for partners who can create targeted campaigns, leverage data analytics, and adapt to changing market trends. Not all marketing agencies are created equal.

Prioritize Conversions – Success Story: Improve sales skills and remove internal operational barriers to convert more leads into starts. For example, one DSO increased booked appointments by 15% and show rates by 20% within 3 months by addressing staffing issues flagged by Patient Prism data.

Patient Prism: Your Partner in Growth

Join us on this journey, and let’s turn the challenges of today into the achievements of tomorrow.

Share // CEO Pulse

Share // CEO Pulse

A few minutes can change everything.

A few minutes can change everything.