Streamlining Due Diligence with Conversational AI

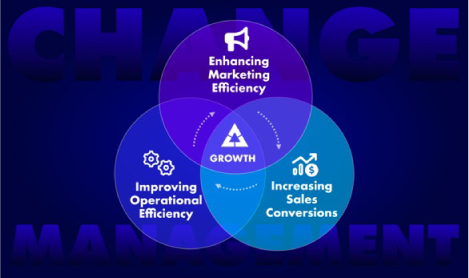

Due diligence is a pivotal process for private equity firms as they evaluate potential investments. Conversational AI tools like Patient Prism offer innovative solutions to streamline this process, providing valuable insights and automating data collection. Let’s explore how these technologies can transform due diligence in the healthcare sector.

Efficient Data Collection

Collecting comprehensive data is the backbone of the due diligence process. Patient Prism excels in this area by automating the collection of patient interaction data, offering a thorough view of a healthcare provider’s operations. This technology captures a wealth of information from patient inquiries, appointment scheduling, and follow-up communications. By automating these tasks, Patient Prism not only saves time but also ensures that data is accurate and up-to-date. For private equity firms, having access to such detailed data is crucial for assessing the efficiency and effectiveness of the provider’s services.

Identifying Operational Strengths and Weaknesses

Once the data is collected, the next step is analysis. Patient Prism goes beyond simple data collection by providing in-depth analysis of the information gathered. It can highlight areas where the healthcare provider excels, such as high patient satisfaction rates or efficient appointment scheduling. Conversely, it can also identify weaknesses, such as high patient churn rates or bottlenecks in the administrative process. This level of detail is invaluable for private equity firms as it allows them to gain a clear understanding of the operational strengths and weaknesses of the healthcare provider, facilitating more informed decision-making.

Risk Mitigation

Understanding potential risks is essential for any investment decision. Patient Prism provides insights that help identify operational risks. For instance, it can detect high patient churn rates, which might indicate underlying issues with patient satisfaction or service quality. It can also pinpoint inefficient processes that could lead to increased operational costs. Armed with this information, private equity firms can better assess the risks associated with an investment and develop strategies to mitigate these risks. This proactive approach to risk management can lead to more successful and profitable investments.

Utilizing conversational AI products like Patient Prism can significantly enhance the due diligence process for private equity firms. By automating data collection, identifying operational strengths and weaknesses, and providing critical insights into potential risks, these tools reduce the time and effort required for thorough evaluations. This streamlined approach not only facilitates better investment decisions but also positions firms to capitalize on opportunities with greater confidence and precision.